Is your company looking to become more sustainable and potentially obtain a business Energy Star certification? The Energy Star program helps companies save money while protecting the environment. Since 1992, the voluntary program has saved businesses more than $500 billion on energy costs.

Businesses that implement energy-efficient measures use energy more efficiently than average and may also be eligible for tax incentives. This results in tangible returns and benefits for any organization.

This guide discusses the requirements and process for businesses to become Energy Star certified and the tax details associated with Energy Star ratings.

What Is an Energy Star Rating?

An Energy Star rating is a measure of how energy-efficient a product is compared to others in its category. Products with an Energy Star rating meet strict guidelines and energy performance standards set by the Environmental Protection Agency (EPA). This rating helps consumers and businesses identify products that use less energy, save money on utility bills and have a lower environmental impact.

You can identify Energy Star-rated products by their blue, square label. Some examples include:

- Appliances

- Buildings and building products

- Electric vehicle chargers

- Electronics

- Heating and cooling products

- Lighting

- Office equipment

- Pool pumps

- Smart home energy management systems

While manufacturers are required to display the yellow Energy Guide label with energy use and operating cost information, the Energy Star label makes it easy to identify the most energy-efficient products.

What Is Energy Star Certified?

An Energy Star-certified item, building or business uses less energy than standard models or practices without compromising on quality or performance. Energy Star certification helps consumers and businesses identify energy-efficient products and services, which can lead to cost savings and reduced environmental impact.

Energy Star Tax Credits for Businesses

These tax credits for businesses are financial incentives that encourage them to invest in energy-efficient technologies and practices. The federal government and many states also reward efficient building upgrades with tax incentives. When you meet Energy Star certification requirements, your company can qualify for some of the tax credits, which can help offset the costs of implementing these measures.

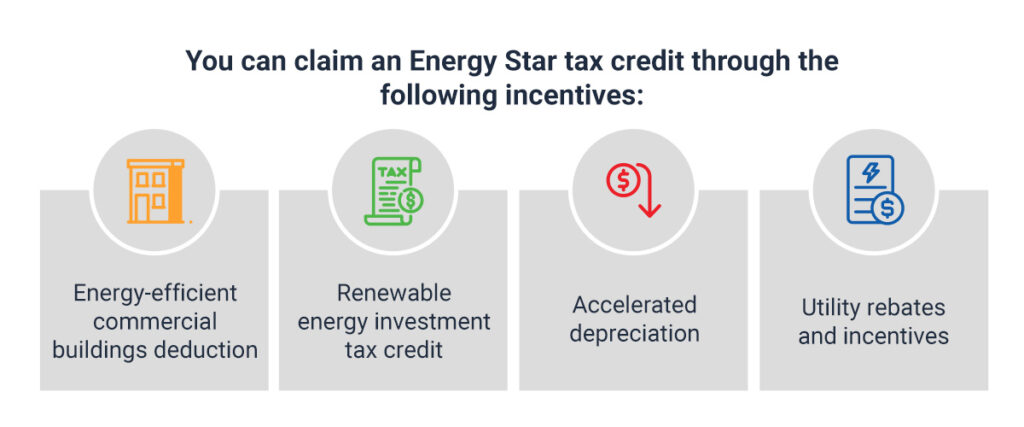

You can claim an Energy Star tax credit through the following incentives:

- Energy-efficient commercial buildings deduction: Your business can qualify for a tax deduction of up to $1 per square foot for improving the energy efficiency of commercial buildings through measures like lighting, heating, cooling and building envelope upgrades.

- Renewable energy investment tax credit: Investing in renewable energy systems like solar panels or wind turbines may make your company eligible for a federal investment tax credit, which can offset a percentage of the cost of the system.

- Accelerated depreciation: You can accelerate the depreciation of energy-efficient equipment, allowing your business to deduct a larger portion of the equipment’s cost in the earlier years of its useful life.

- Utility rebates and incentives: Many utility companies offer rebates and incentives for businesses that implement energy-efficient technologies or practices, which can also help offset upfront costs.

Although not all Energy Star-certified products qualify for a tax credit, businesses can claim for these improvements:

- HVAC systems: Heating, ventilation and air conditioning (HVAC) systems can help companies reduce energy consumption.

- Lighting: Energy Star-certified LED bulbs, fixtures and lighting systems can help businesses save on energy costs.

- Commercial kitchen equipment: Certified commercial kitchen appliances, such as refrigerators, dishwashers and ovens, can qualify for tax credits.

- Office equipment: Some certified products, such as computers, monitors and printers, can help companies save energy.

- Building envelope improvements: Improvements to buildings include energy-efficient windows, doors, insulation and roofing materials.

How Can Businesses Achieve Energy Star Certification?

For any product to be Energy Star certified, it must meet strict energy efficiency criteria set by the EPA or the U.S. Department of Energy (DoE). The metric for energy efficiency differs for each product category and is determined by a series of tests. These testing methods and criteria evolve as new features and efficiency technologies are added to certain products.

Some benefits for businesses getting Energy Star certified include:

- Potential for higher building valuation, occupancy rates and rental premiums

- Significant energy cost savings and greenhouse gas emission reductions

- Enhanced corporate sustainability and reduced environmental impact

- Better alignment with the company’s social and environmental values

- Better financing terms and federal tenant leasing opportunities

- Improved brand image and competitive advantage

- Lower utility bills and higher operational efficiency

- Ongoing commitment to energy management

Energy Star Certification Requirements for Businesses

Businesses can achieve Energy Star certification by following these general steps:

- Benchmarking: Companies need to benchmark their energy performance using Portfolio Manager, a free online tool provided by Energy Star. Benchmarking involves entering energy usage data for the building and comparing it to similar buildings. You need to receive an Energy Star score of 75% or higher, accounting for all energy use on the entire property.

- Compliance: Ensure the building meets the energy efficiency requirements set by Energy Star for its specific type. Have a licensed professional conduct a site visit and implement energy-saving measures to improve efficiency if necessary.

- Documentation: Gather necessary documentation, such as utility bills, property information and other data required for the certification process.

- Application: Submit the application through Portfolio Manager for Energy Star certification. The EPA will review the application and verify the energy performance of the building.

- Certification: If your building meets the energy efficiency criteria, it will receive Energy Star certification, which signifies that you are one of the top performers in terms of energy efficiency.

Additional Energy Efficiency Measures

As a business leader, you can take additional measures to improve your energy efficiency beyond obtaining Energy Star certification. Some effect strategies include:

- Utility bill auditing: Conduct regular energy and utility bill audits to identify areas of energy waste and inefficiency within business operations.

- Upgrade lighting: To reduce electricity consumption, switch to energy-efficient LED lighting and use natural or skylights where possible.

- HVAC system maintenance: Maintain your HVAC systems to improve their efficiency and reduce energy usage.

- Insulation and sealing: Ensure windows, doors and ductwork are insulated and sealed to prevent energy loss.

- Energy-efficient equipment: Invest in energy-efficient appliances, machinery and equipment to reduce energy consumption.

- Smart building technologies: Implement smart technology, such as automated lighting, HVAC controls and commercial energy management systems, to optimize energy use.

- Employee engagement: Educate your employees on energy-saving practices and encourage them to participate in energy conservation efforts.

- Flexible work arrangements: Promote telecommuting and flexible work arrangements to reduce the need for office space and commuting, thus saving energy.

UtiliSave Can Help You Become Energy Star Certified

Utility bill audits can play a crucial role in helping businesses like yours meet the energy efficiency requirements for Energy Star certification. By conducting utility bill audits, you can identify areas of energy waste, misreadings and opportunities for improvement that will lead to accurate ratings.

Our team at UtiliSave has helped many clients save money by correcting overcharges and identifying savings opportunities. Our utility bill audit services provide valuable data on your organization’s energy use patterns and can help you benchmark energy performance.

To learn more about how our auditing services can help you achieve your energy efficiency goals, get in touch with us.